Date | Open price* | Upper Price | Lower Price | Close price** | Vol |

|---|

2026-01-14 | $0.000091 | $0.000118 | $0.000091 | $0.000114 | $6,841.473 |

2026-01-13 | $0.000080 | $0.000105 | $0.000080 | $0.000091 | $12,605.69 |

2026-01-12 | $0.000178 | $0.000163 | $0.000079 | $0.000080 | $28,306.02 |

2026-01-11 | -- | $0.000196 | $0.000162 | -- | -- |

* Earliest data in range (UTC time)

** Latest data in range (UTC time)

About RIDER historical price data

The RIDER price history tracker allows cryptocurrency investors to conveniently monitor the performance of their investments. You can easily view the opening, highest, and closing prices of RIDER over time, as well as the trading volume. In addition, you can instantly check the daily percentage change to easily identify days with higher volatility.

According to our RIDER price history data, its value surged to an all-time high of over $0.000196 in 2026-01-11. On the other hand, the lowest point in the RIDER price trajectory (often referred to as the “RIDER all-time low”) occurred in 2026-01-12. Anyone who purchased RIDER during that period would currently enjoy an impressive profit of $0.000117.

By design, the total supply of RIDER will reach 1,000M. As of now, the circulating supply of RIDER is approximately 1,000M.

All prices shown on this page come from trusted data provider LBank. When reviewing your investments, it is recommended not to rely on a single data source, as values may differ between providers.

Our historical Bitcoin price dataset includes 1-minute, 1-day, 1-week, and 1-month data (open/high/low/close/volume). These datasets have been rigorously tested to ensure consistency, integrity, and accuracy. The design is specifically for trading simulations and backtesting, available for free download and updated in real time.

RIDER historical data examples

Here are some uses of RIDER historical data in RIDER trading

Technical analysis:

Traders use historical data to analyze trends and movements in the RIDER market. They use charts and other visual tools to identify trends and determine when to enter or exit the market. One way to gain an advantage in this dynamic market is to visualize and analyze historical market data. To achieve this, historical data can be stored in GridDB and analyzed using Python scripts with various libraries, such as Matplotlib, Pandas, Numpy, and Scipy for data visualization.

Predicting RIDER price based on historical data:

Historical data can also be used to predict future market trends. By analyzing past market behavior, traders can identify recurring patterns and make informed predictions about the direction of the RIDER market. By using LBank’s RIDER historical dataset, traders can obtain minute-by-minute data such as open, high, low, and close prices for RIDER. These data can then be used to define and train price prediction models, helping users make informed trading decisions.

Risk management:

By obtaining historical data, traders can assess the risks of investing in RIDER. They can also determine the volatility of RIDER, allowing them to make sound investment decisions.

Portfolio management:

Historical data is also useful in portfolio management. By tracking investments over the long term, traders can identify underperforming assets and adjust portfolios to maximize returns.

Training RIDER trading bots:

In addition, users can choose to download RIDER historical cryptocurrency OHLC (open, high, low, close) data to train their own RIDER trading bots, achieving outstanding performance in the market. With these tools and resources, traders can deeply study RIDER’s historical data, gain valuable insights, and potentially improve their trading strategies.

How to analyze RIDER candlestick chart data

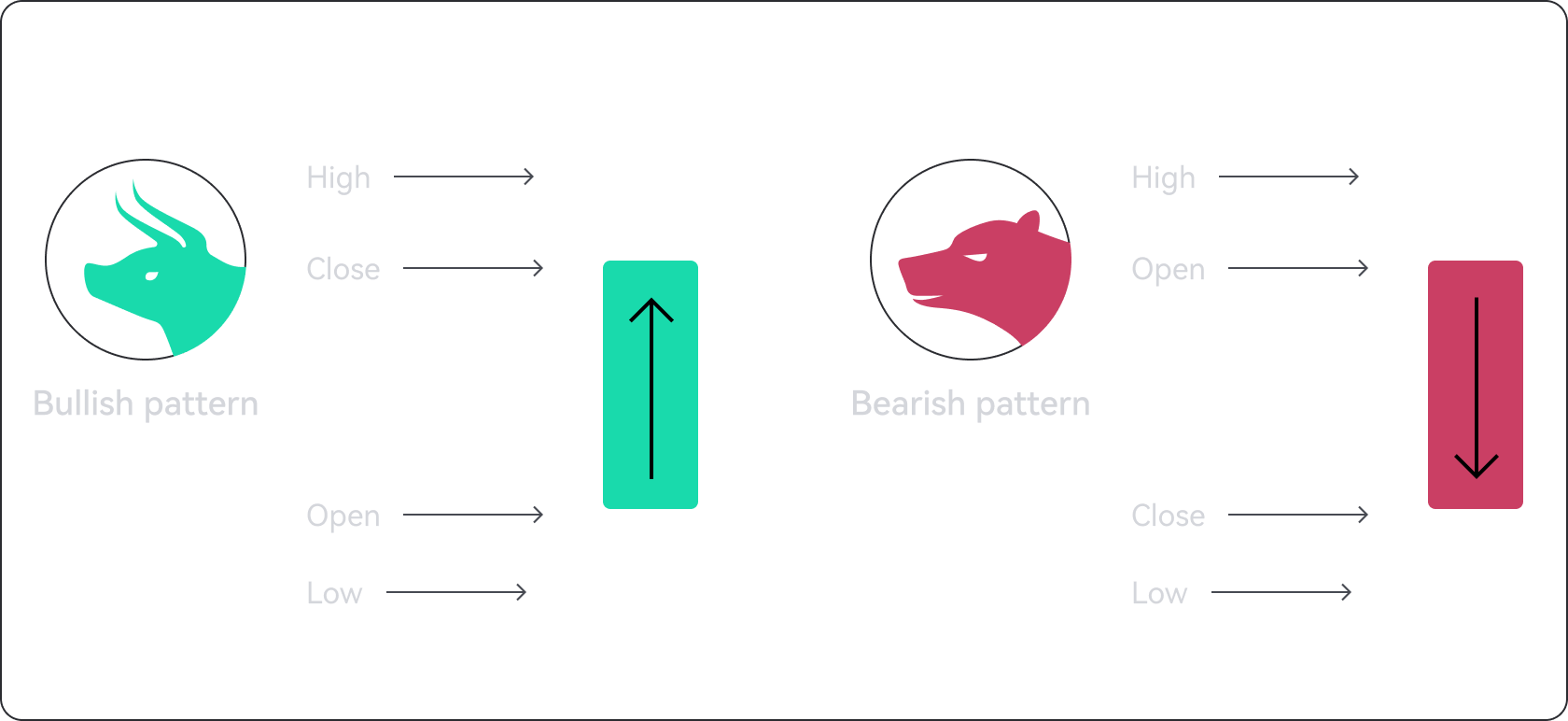

RIDER candlestick charts display time on the horizontal axis and price data on the vertical axis, similar to line and bar charts. A candlestick may have two different colors: green or red. A green candle indicates a price increase during the considered period, while a red candle indicates a price decrease.

The simple structure of candlestick charts can provide users with a wealth of information. For example, technical analysis may use candlestick chart data to identify potential trend reversals.

According to RIDER historical data, when the RIDER market shows bearish or bullish trends, conservative investors may choose to use capital-protected products such as Flexible and Locked to capture the trend at that time. When RIDER is in a sideways trend, using Open Futures and selecting a bullish product to take advantage of a slight upward trend, or choosing a bearish product to profit from a mild downward trend, may lead to better performance.  Seal the Night Rider(RIDER)

Seal the Night Rider(RIDER)

Seal the Night Rider(RIDER)

Seal the Night Rider(RIDER)