What is the Kelly Criterion in Trading

The Kelly Criterion is a mathematical formula that helps traders and investors calculate the optimal size for their positions.

Created in 1956 by John L. Kelly Jr. at Bell Labs, this formula aims to maximize the long-term growth rate of capital.

The method works by calculating what percentage of your total capital you should risk on each trade based on your historical performance and probability of success.

At its core, the Kelly Criterion maximizes the expected value of the logarithm of wealth rather than simple returns. This approach focuses on compound growth over time while reducing the risk of losing everything. The formula has become a cornerstone of modern risk management in trading, sports betting, and investment portfolio management.

Review BTC Price on LBank

BTC() Price

The current price of

The Kelly Formula Explained

The Kelly Criterion uses two different formulas depending on your situation. Both calculate f*, the optimal fraction of your capital to bet or invest.

The Original Kelly Formula

For a simple bet with two outcomes (win or lose), the formula is:

f* = (bp - q) / b

Where:

- f* = the fraction of your current bankroll to bet

- b = the net odds received on the wager (payout for each dollar bet)

- p = the probability of winning

- q = the probability of losing (equal to 1 - p)

For example, imagine a coin flip where you win $2 for every $1 bet (b = 2), and you have a 60% chance of winning (p = 0.6, q = 0.4). The Kelly formula suggests: f* = (2 × 0.6 - 0.4) / 2 = 0.8 / 2 = 0.4 or 40% of your bankroll.

The Trading System Formula

For trading systems with historical data, traders use a simplified version:

Kelly Percentage = W - [(1-W) / R]

Where:

- W = Your historical winning percentage (win rate)

- R = Your average win/loss ratio (average profit on winners divided by average loss on losers)

Both formulas achieve the same goal but work with different inputs. The original formula needs exact probabilities and payoffs. The trading formula uses your actual trading history. Most traders find the second formula more practical since they can calculate it from their trade logs.

History and Development Timeline

The Kelly Criterion emerged from an unexpected source - telephone engineering. Here's how it evolved:

John L. Kelly Jr. publishes "A New Interpretation of Information Rate"

Introduces the mathematical foundation while working on phone line noise problems at Bell Labs

Edward O. Thorp applies Kelly to blackjack

Revolutionizes gambling with card counting strategies in "Beat the Dealer"

Finance industry adoption begins

Portfolio managers start using Kelly for position sizing

Systematic traders embrace the method

Trend followers and algorithmic traders incorporate Kelly into risk management

Cryptocurrency traders adopt Kelly

Digital asset traders use modified Kelly strategies for volatile markets

The formula's journey from telephone lines to trading desks shows how mathematical concepts can find unexpected applications. Kelly originally developed his criterion to solve problems with random noise in communication channels. He drew parallels between a gambler receiving imperfect information and data transmission over noisy phone lines.

Warren Buffett and Charlie Munger, image by: Robyn Twomey/Redux/laif

Key Figures Who Used the Kelly Criterion

Edward O. Thorp stands out as the person who transformed Kelly's academic formula into a practical tool. After successfully using it for blackjack, Thorp applied the same principles to the stock market. His hedge fund, Princeton Newport Partners, achieved returns of 19.1% annually over 29 years using Kelly-based position sizing.

Warren Buffett and Charlie Munger follow Kelly principles without explicitly naming the formula. Buffett has stated he prefers putting "meaningful amounts of money in a few things" rather than spreading investments too thin. This concentrated approach aligns with Kelly's mathematics - when you have a genuine edge, the formula suggests larger position sizes.

Bill Gross, the famous bond investor, openly credits the Kelly Criterion for his portfolio allocation decisions. Claude Shannon, Kelly's colleague at Bell Labs and the father of information theory, also used the criterion for his personal investments. Michael Covel popularized Kelly concepts in trend following through his TurtleTrader platform and books, teaching traders how to size positions based on their statistical edge.

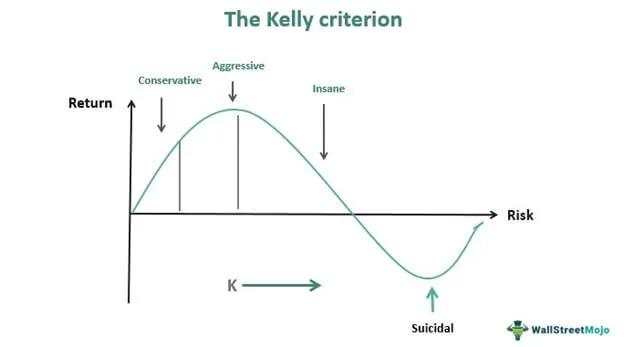

Fractional Kelly Strategy for Risk Management

Full Kelly betting is mathematically optimal but practically dangerous. The formula assumes perfect knowledge of probabilities and payoffs. Real markets don't provide such certainty. Overestimating your edge by just 10% can double your recommended bet size, potentially leading to massive drawdowns.

Fractional Kelly solves this problem by using only a portion of the full Kelly amount. Common fractions include:

- Half Kelly (50%): Reduces volatility by about 25% while sacrificing only 25% of long-term growth

- Quarter Kelly (25%): Cuts volatility in half with minimal impact on returns

- One-Tenth Kelly (10%): Ultra-conservative approach for uncertain markets

Professional traders typically use between 10% and 25% of full Kelly. This conservative approach protects against estimation errors and reduces emotional stress during drawdowns. A trader whose full Kelly calculation suggests risking 20% might only risk 5% using quarter Kelly. This smaller position size creates a smoother equity curve and helps traders stick to their system during losing streaks.

The Kelly criterion, image by WallstreetMojo

Kelly Criterion vs Other Portfolio Models

The Kelly Criterion serves a different purpose than other popular financial models. While Black-Scholes calculates option prices and Modern Portfolio Theory determines asset allocation, Kelly focuses purely on position sizing given a specific opportunity.

The Kalman Filter, another mathematical tool from engineering, estimates values when precise measurements are impossible. Traders sometimes combine Kalman filtering with Kelly sizing - using Kalman to predict price movements and Kelly to determine how much to bet on those predictions.

Unlike Modern Portfolio Theory, which considers correlations between multiple assets, Kelly traditionally evaluates each bet independently. This simplification makes Kelly easier to implement but less sophisticated for complex portfolios. Some quant funds now use "Universal Portfolio" algorithms that extend Kelly concepts to multiple simultaneous positions.

Review ETH Price on LBank

ETH() Price

The current price of

Applying Kelly to Cryptocurrency Trading

Cryptocurrency markets present unique challenges for Kelly implementation. The extreme volatility requires constant recalculation of probabilities and position sizes. Here's a practical framework for crypto traders:

Step 1: Gather Historical Data

Track at least 100 trades to establish reliable win rates and profit ratios. Crypto markets change rapidly, so focus on recent data from the past 3-6 months rather than years-old statistics.

Step 2: Calculate Your Edge

Use either formula depending on your data. If you know exact probabilities and payoffs, use f* = (bp - q) / b. If you have historical trading data, use Kelly% = W - [(1-W) / R]. Most crypto traders use the second formula since it works with actual results.

Step 3: Apply Fractional Kelly

Given crypto's volatility, never use full Kelly. Start with one-tenth Kelly and gradually increase as you gain confidence in your system.

Step 4: Adjust for Market Conditions

Reduce position sizes during high volatility periods or when trading new tokens with limited history. Increase sizes slightly for established cryptocurrencies with more predictable patterns.

Step 5: Rebalance Regularly

Update your Kelly calculations weekly or after every 20 trades. Crypto markets evolve quickly, and yesterday's winning strategy might not work tomorrow.

Limitations and Risks in Real Trading

The Kelly Criterion faces several critical limitations that traders must understand. First, the formula requires accurate probability estimates. In crypto markets, where a single tweet can trigger 20% price swings, calculating reliable probabilities becomes nearly impossible. The formula also ignores transaction costs, which can be substantial in crypto trading. Network fees, exchange fees, and slippage all reduce actual returns below theoretical calculations.

Psychological factors present another challenge. Full Kelly positions can create drawdowns exceeding 50%, even with a positive edge. Few traders can stomach watching half their account disappear, even temporarily. The formula also assumes infinite trading opportunities, but real markets offer limited high-quality setups.

The Kelly Criterion doesn't account for black swan events - rare but extreme market moves that can wipe out overleveraged positions. In crypto, these events happen more frequently than in traditional markets. Exchange hacks, regulatory crackdowns, or technical failures can cause instant, massive losses that Kelly calculations cannot predict.

Modern Applications and Tools

Today's traders use software to implement Kelly strategies automatically. Popular trading platforms like TradingView and MetaTrader allow custom Kelly calculators. Python libraries such as PyPortfolioOpt include Kelly optimization functions for algorithmic traders.

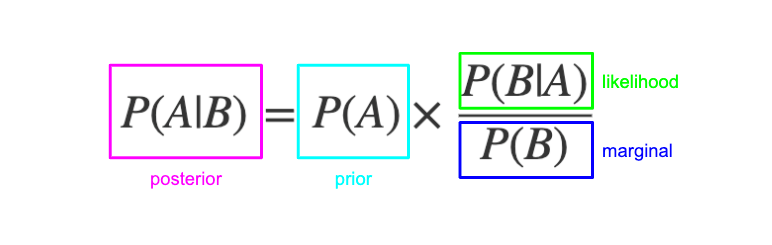

Bayesian Rule, Image by: Peter Gleeson

Several modifications have emerged for modern markets:

- Dynamic Kelly: Adjusts position sizes based on market volatility indicators

- Bayesian Kelly: Updates probability estimates as new data arrives

- Kelly with Stop Losses: Incorporates maximum loss limits into the calculation

- Multi-Asset Kelly: Extends the formula to portfolio-wide position sizing

Cryptocurrency-specific tools now exist too. Platforms like 3Commas and Shrimpy offer Kelly-based position sizing for crypto portfolios. These tools automatically adjust position sizes based on recent performance and market conditions.

Practical Implementation Guidelines

Success with Kelly requires discipline and proper implementation. Start by paper trading with Kelly sizes to understand how the system behaves. Track every trade meticulously - the formula needs accurate data to work properly. Never risk more than 20% on a single position, regardless of what Kelly suggests. This hard limit protects against calculation errors and black swan events.

Set up a systematic review process. Recalculate your Kelly percentage monthly or after significant market changes. If the formula produces a negative number, stop trading that strategy immediately. A negative Kelly means you're expected to lose money over time.

Consider market conditions when applying Kelly. Reduce sizes during major news events, low liquidity periods, or when trading unfamiliar assets. Increase sizes gradually as you gain confidence and verify your edge remains consistent.

Remember that Kelly optimizes for maximum growth, not maximum safety. If preserving capital matters more than growth, use smaller fractions or different risk management methods entirely. The best position sizing system is one you can follow consistently through both winning and losing streaks.