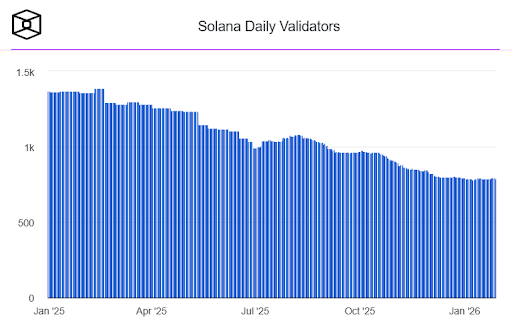

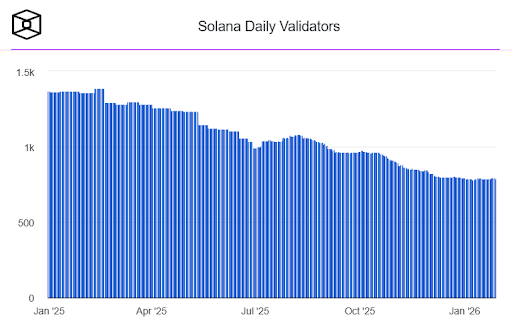

Solana has entered 2026 with significant developments that highlight both its strengths and the hurdles it needs to overcome. The blockchain that once boasted over 2,500 validators in early 2023 now operates with fewer than 800—a decline of more than 65%.

This drop mirrors a similar decrease in daily vote transactions, which have fallen from approximately 300,000 to 170,000.

Image via The Block

Why Solana Validator Numbers Are Dropping

The reduction in validators stems from changing economic conditions within the network.

The Solana Foundation Delegation Program previously provided support for vote costs and stake matching, but this assistance was designed to decrease gradually. As the support winds down, smaller validators struggle to cover their operational expenses.

Running a Solana validator requires submitting thousands of transactions daily to stay synchronized with the network. Without enough staked SOL to generate returns that exceed these costs, many operators find it financially unsustainable to continue.

This economic pressure has pushed the validator count to levels last seen in 2021.

Solana’s Core Issue: High Usage, Low Value Capture

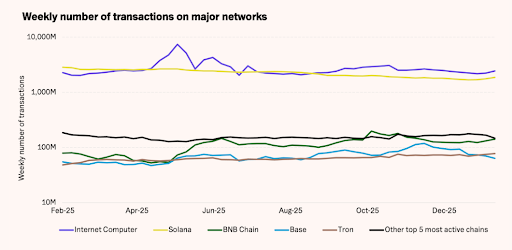

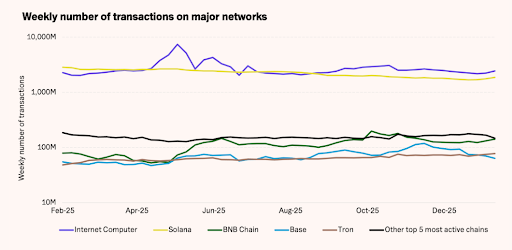

Despite processing roughly 2.2 billion transactions weekly and hosting 16.7 million active addresses, Solana faces a fundamental monetization challenge.

Image via 21Shares

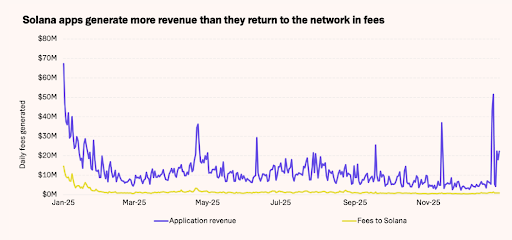

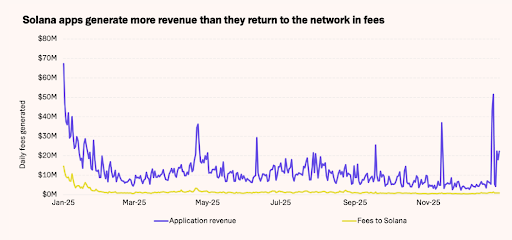

According to 21Shares, of the approximately $10 million in daily ecosystem fees, less than $100,000—under 10%—flows back to the protocol itself. The rest goes to applications built on the network.

Image via 21Shares

This creates what analysts call a "high-volume, low-capture" model. The network can handle massive activity, but most economic value bypasses SOL token holders entirely.

For comparison, Visa processes nearly $16 trillion in payments annually and captures about 0.27% as revenue. Solana's take rate sits at roughly 0.04% of its $1.5 trillion in transaction volume.

Inflation Without Relief

Unlike Ethereum, Solana no longer burns tokens based on network usage. With inflation running at about 4% annually and approximately 70% of the supply staked, the network relies heavily on sustained staking demand to absorb new token issuance.

There's a proposal called SIMD-0411 that would reduce inflation to 30% annually, which could benefit existing holders by limiting dilution.

The network did make progress on reliability with Firedancer's public launch in December 2025. This new validator client means Solana no longer depends on a single software system.

Currently, about 71% of the network runs on Jito, 17% on Frankendancer, and 12% on Agave. This distribution reduces risk and improves long-term stability.

Why Institutions Are Still Building on Solana

Despite all these, WisdomTree recently announced that it's bringing its complete suite of tokenized funds to Solana, including money market, equity, fixed income, and asset allocation products.

Image via X

The firm manages over $772 million in assets across multiple blockchains, and this expansion reflects growing confidence in Solana's infrastructure.

Solana now hosts over $15 billion in stablecoins, making it a major hub for dollar-based transactions.

Galaxy Digital tokenized its publicly listed equity on the network, followed by a $50 million commercial paper issuance arranged by JPMorgan. Companies like Exodus and Forward Industries have announced similar plans.

SOL Price Outlook for 2026: Bull, Base, and Bear Scenarios

In its report, 21Shares released scenario-based price projections for SOL throughout 2026:

- Its base case estimates $150 (representing a 21% gain from the current price), assuming moderate growth in activity and stablecoin balances with marginal improvements in protocol capture

- Its bull case projects $197 (a 59% increase) if revenue from fees rises meaningfully and institutional settlement scales beyond pilot programs

- The bear case sits at $95 (a 23% decline) if protocol capture fails to improve and staking demand weakens

What Solana’s Tradeoffs Mean for Users and Holders

For traders and developers, Solana's high throughput and low costs remain attractive. The network excels at payments, trading, and settlement, where speed matters more than complex smart contract interactions.

However, the lack of protocol-level revenue growth means the network's success doesn't automatically translate to value for SOL holders.

The path forward depends on whether Solana can improve fee capture while maintaining its performance advantages. Without structural changes to how value flows through the network, growth in activity may not drive proportional growth in token value.

SOL Key Metrics at a Glance

SOL Price: $125.56

SOL Market Cap: $71.07B

SOL Circulating Supply: 566.06M

SOL Total Supply: 619.17M

SOL Market Ranking: #7