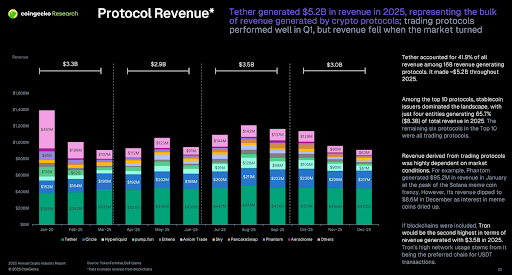

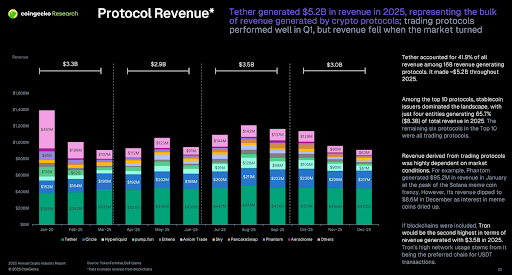

Tether cemented its position as cryptocurrency's most profitable company in 2025, generating approximately $15 billion in profit and capturing 41.9% of total revenue across 168 tracked crypto protocols.

The stablecoin giant's performance highlights how dollar-backed tokens have become the sector's most reliable moneymakers, even as broader market conditions weakened.

How Tether’s Reserve Strategy Drives Outsized Profits

According to CoinGecko's annual report, Tether earned roughly $5.2 billion in revenue during 2025, significantly outpacing competitors.

Image via X

The company's business model centers on issuing USDT tokens backed by reserves held primarily in U.S. Treasury bills, Bitcoin, and gold.

With over $187 billion in assets by early 2026, Tether ranks as the 17th-largest holder of U.S. Treasuries globally—ahead of countries like Germany, South Korea, and Australia.

Elevated interest rates through 2025 allowed Tether to collect substantial yields on Treasury holdings without passing returns to USDT holders. This created exceptional profit margins with fewer than 200 employees.

CEO Paolo Ardoino emphasized the company's institutional role: "We are operating at a scale that places the Tether Gold investment fund on par with sovereign gold holders."

Stablecoin issuers dominated crypto revenue rankings in 2025. The top four companies—Tether, Circle, Ethena, and others—collectively generated around $8.3 billion, representing over 65% of the top 10 earners.

This came despite total crypto market capitalization falling roughly 10% to $3 trillion.

Tether’s Gold Strategy Puts It Alongside Central Banks

Tether became one of the world's most active gold buyers in late 2025, purchasing 27 tonnes in the fourth quarter alone—nearly matching its 26-tonne acquisition in Q3. This positions Tether alongside central banks as a major accumulator.

Poland's central bank, the most active among reporting institutions, added just 35 tonnes in Q4.

The buying spree coincided with gold prices surging past $5,000 per troy ounce in early 2026 as central banks diversified away from dollar assets.

Tether's gold-backed XAUT token now accounts for 60% of global supply among gold-backed stablecoins, with the company holding approximately 104 tonnes in total reserves.

USA₮ Launch Marks Tether’s Entry Into Regulated U.S. Markets

On January 27, 2026, Tether launched USA₮, a federally regulated stablecoin designed for the United States market. Unlike USDT, which operates globally but excludes most U.S. citizens, USA₮ complies with the GENIUS Act's federal framework.

Image via X

Anchorage Digital Bank issues USA₮, making it America's first federally regulated stablecoin.

Cantor Fitzgerald serves as reserve custodian, with former White House Crypto Council Executive Director Bo Hines leading as CEO of Tether USA₮.

"USA₮ offers institutions an additional option: a dollar-backed token made in America," Ardoino said. He added that "USD₮ has proven for more than a decade that digital dollars can deliver trust, transparency, and utility at global scale."

Why USDT Is Core Infrastructure for Global Crypto Markets

USDT's market capitalization exceeded $187 billion across multiple blockchains by early 2026, with daily trading volumes surpassing all competitors combined. The token serves as essential infrastructure for trading, cross-border payments, and dollar access in developing economies.

Tron blockchain ranked second overall in protocol revenue at approximately $3.5 billion, largely from hosting USDT transactions. This demonstrates how Tether's success creates spillover benefits for infrastructure providers.

Tether’s $1B+ Push Beyond Stablecoins

Tether has expanded aggressively beyond stablecoins with over $1 billion invested across:

- AI robotics (Neura Robotics)

- Social media (48% stake in Rumble for $775 million)

- Satellites (Satellogic)

- Computing (Northern Data)

- Agriculture (70% stake in Adecoagro)

This diversification aims to reduce dependence on interest rate fluctuations.

Regulatory Risks and the Cost of Stablecoin Dominance

Tether's dominance creates concentration risks. Any regulatory action or reserve issues could trigger widespread disruptions given USDT's central role. U.S. authorities continue investigations while European MiCA regulations present compliance challenges.

However, the USA₮ launch signals willingness to work within regulatory frameworks. Tether's massive treasury holdings also create an unusual dynamic where crypto capital flows back into U.S. government debt, reinforcing digital dollar dominance.

USDT Key Metrics at a Glance

USDT Current Price: $0.999

USDT Market Cap: $186.36B

USDT 24-Hour Volume: $88.88B

USDT Circulating Supply: 186.53B

USDT Total Supply: ∞

USDT Market Ranking: #3