What is Infinex and Why Does It Matter for DeFi?

Decentralized finance offers users full control over their assets, but the experience often frustrates newcomers. Managing seed phrases, switching between wallets, and bridging assets across chains creates friction that pushes many users toward centralized exchanges. Infinex aims to solve this problem by combining the simplicity of centralized platforms with the security of self-custody.

Infinex is a non-custodial crypto superapp that uses passkey technology instead of traditional seed phrases or passwords. The platform provides a unified interface for trading, lending, and asset management across more than 20 blockchains. Users can access Ethereum, Solana, Base, Arbitrum, Optimism, and Polygon through a single dashboard without manually switching wallets or using external bridges.

The project describes its mission as solving two core problems in DeFi. The first is the "Complexity Barrier," which refers to the difficulty of managing seed phrases and understanding wallet security. The second is the "Fragmented Multi-Chain Experience," where users must juggle multiple wallets and bridges to interact with different blockchains. Infinex addresses both issues by offering what the team calls "Web2 simplicity with Web3 security."

Check INX Price on LBank

INX() قیمت

قیمت فعلی

Who Founded Infinex? Kain Warwick and the Synthetix Connection

Infinex was founded by Kain Warwick, a well-known entrepreneur in the DeFi space. Warwick previously co-founded Synthetix, one of the earliest and most influential decentralized derivatives protocols. His experience building complex DeFi infrastructure directly shaped the vision for Infinex.

The Governing Foundation

The project operates under the Sempiternal Autarky Foundation, which is based in the Cayman Islands. This foundation structure provides legal clarity for the project while maintaining its decentralized governance model. The foundation oversees protocol development and coordinates with the community through governance mechanisms tied to Patron NFTs and INX tokens.

Warwick has been vocal about making DeFi accessible to mainstream users without sacrificing the core principles of self-custody. His background at Synthetix demonstrated that complex financial instruments could work onchain, and Infinex represents his attempt to bring that functionality to everyday users who may not have technical expertise.

How Infinex Raised $72 Million: Funding Breakdown

Infinex has raised approximately $72.49 million in total funding through two primary events. The funding strategy combined NFT sales with a traditional token sale, and it attracted notable participants from across the crypto industry.

Patron NFT Sale: $68 Million in September 2024

The Patron NFT sale in September 2024 raised $68 million. This sale established the initial community of governance participants and created significant early momentum for the project.

Notable industry figures participated in the Patron NFT sale:

- Vitalik Buterin — Ethereum co-founder

- Anatoly Yakovenko — Solana co-founder

- Jesse Polak — Base founder

- Stani Kulechov — Aave founder

The participation of these founders signaled confidence in Warwick's vision and brought attention from their respective communities.

Sonar Sale: $7.2 Million in January 2026

The Sonar Sale was a public token sale for INX that took place between January 3 and January 10, 2026. This sale raised $7.2 million and preceded the Token Generation Event.

The Sonar Sale faced challenges during its initial launch. Warwick publicly acknowledged "weak initial demand" and responded by restructuring the sale terms. He adjusted the valuation to a $99.99 million FDV (Fully Diluted Valuation) to ensure what he described as a "fair entry" for participants. This transparent approach to addressing market feedback demonstrated the team's willingness to adapt.

Institutional Backing

Notable institutional investors backing Infinex include:

| Investor | Category |

| Framework Ventures | Crypto VC |

| Bankless Ventures | Media/VC |

| Solana Ventures | Ecosystem Fund |

| Wintermute | Market Maker |

The combination of ecosystem funds, venture capital, and market makers provides Infinex with both capital and operational support for liquidity and exchange listings.

How Passkey Technology Works on Infinex

The technical architecture of Infinex centers on passkey technology, which replaces traditional authentication methods with device-stored cryptographic keys. This approach eliminates the need for users to manage seed phrases while maintaining non-custodial security.

Passkeys vs. Seed Phrases

Traditional crypto wallets require users to write down and securely store a 12 or 24-word seed phrase. If someone loses this phrase, they lose access to their funds forever. If someone else finds the phrase, they can steal everything. Infinex removes this friction by using passkeys.

Passkeys utilize cryptographic public/private key pairs stored directly on the user's device. When a user authenticates, the device signs a challenge using the private key without ever exposing it. This method is resistant to phishing attacks because the private key never leaves the device. It also protects against server leaks because the server only stores the public key.

Security Layers and Fund Recovery

Infinex implements multiple security layers to protect users beyond the passkey system:

- Double Authentication (2FA): Uses the TOTP (Time-based One-Time Password) protocol to add a second verification layer and mitigate passkey theft risks

- Fund Recovery: Users can link Google or Apple accounts to their Infinex account, or connect specific EVM and Solana addresses for recovery if a passkey is lost

- Biometric Integration: Device biometrics like Face ID or fingerprint scanning can be used for transaction confirmation

The recovery system addresses a major concern with passkey-only systems. If a user loses their device, the linked accounts or addresses provide a path to regain access without exposing funds to third-party custodians.

Unified Multi-Chain Interface

The platform integrates multiple blockchains through a single interface. Users do not need to manually switch networks or use external bridge services.

Key integrations include:

- Swidge: DEX aggregation for optimal swap routing across chains

- Hyperliquid: Perpetual futures trading integration

- Native Support: Ethereum, Solana, Base, Arbitrum, Optimism, Polygon, and 14+ additional chains

This unified approach means users can hold assets on different chains and interact with DeFi protocols across the ecosystem without leaving the Infinex interface.

Infinex vs. Traditional DeFi Wallets

The key differentiator for Infinex is the combination of non-custodial security with simplified user experience. Centralized exchanges offer easy interfaces but require users to trust the exchange with their funds. Traditional DeFi wallets offer self-custody but demand technical knowledge and careful seed phrase management. Infinex attempts to deliver self-custody with exchange-level simplicity.

Patron NFTs Explained: Governance and Value

The Patron NFT collection forms a core component of the Infinex ecosystem. These NFTs provide governance rights and represent a significant portion of the value deposited on the platform.

Supply and Utility

The Patron NFT collection has a fixed supply of 100,000 NFTs. Holders gain governance power through the ability to elect a 6-member council that guides protocol development. Additional utility includes access to future exclusive features and benefits as the platform evolves.

Market Position and TVL Impact

As of current updates, the Patron NFT collection has a market capitalization of approximately $530 million. This valuation theoretically makes it the second-largest NFT collection after CryptoPunks.

The Patron NFT holders represent a significant portion of platform activity:

| Metric | Value |

| Patron NFT Market Cap | $530 million |

| Patron Share of TVL | 92% |

| Organic TVL (excluding Patrons) | $39 million |

The 92% figure indicates that most value deposited on Infinex comes from Patron holders. The organic TVL of $39 million represents usage from non-Patron participants. This concentration suggests the platform is still in early stages of broader adoption beyond its initial community.

INX Tokenomics: Supply, Utility, and Buyback Mechanism

The INX token launched on January 30, 2026, following the Token Generation Event (TGE). It serves as the primary utility and governance token for the Infinex ecosystem.

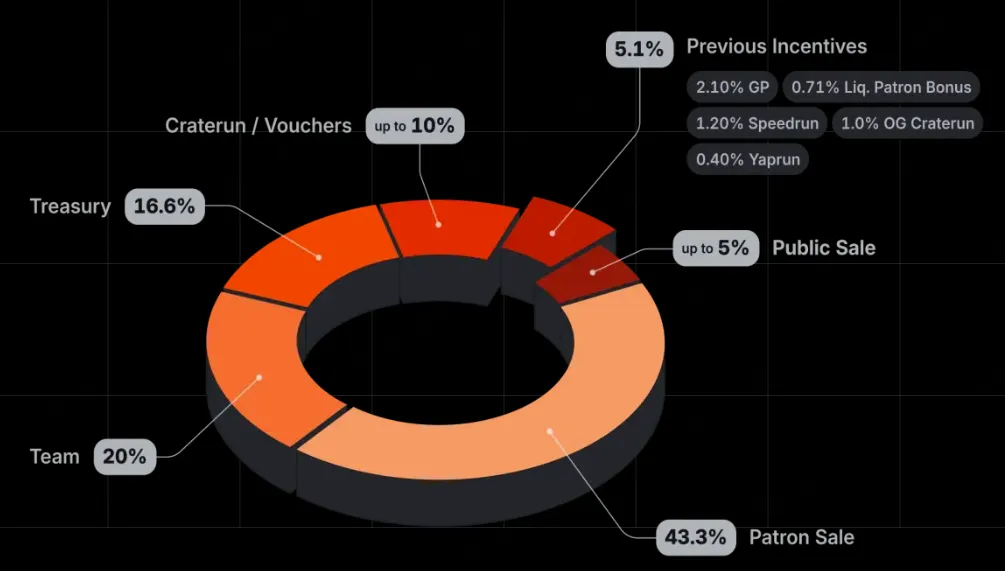

INX tokenomics, image source: Infinex

INX Token Supply and Distribution

The total supply of INX is capped at 10 billion tokens. The token was listed on major exchanges including LBank in late January 2026, providing immediate liquidity for holders.

INX Token Utility

INX tokens provide multiple benefits within the Infinex ecosystem:

- Governance: Voting rights on protocol decisions and parameter changes

- Fee Discounts: Reduced platform fees for token holders

- Early Access: Priority access to new features and integrations

- Gas Subsidies: Token holders receive subsidies for transaction costs

Revenue Model and Buyback Mechanism

Infinex generates revenue through platform fees on trading and other services. The protocol uses these fees to fund a buyback mechanism where INX tokens are purchased from the open market. Purchased tokens are locked for a minimum of one year.

This buyback model creates consistent buy pressure on the token while aligning the protocol's success with token value. As platform usage grows, more fees are generated, which leads to more buybacks. The one-year lock period prevents immediate selling and supports long-term price stability.

Infinex Timeline: From Launch to Token Generation

Platform Public Launch

Introduction of keyless wallet technology

Patron NFT Sale

Raised approximately $68 million

Yaprun Campaigns

Gamified community participation programs

Sonar Sale

Public INX token sale raised $7.2 million

Token Generation Event

INX token officially launched

Exchange Listings

INX listed on LBank

Team Token Unlock

Scheduled unlocking of team allocations

The timeline shows steady progression from platform launch through token generation. The gap between the Patron NFT sale in September 2024 and the INX token launch in January 2026 allowed the team to build platform functionality and community engagement before introducing the token economy.

What Infinex Could Mean for the Future of Crypto Adoption

Infinex represents a serious attempt to bridge the gap between centralized convenience and decentralized principles. The passkey-first approach removes one of the biggest friction points in crypto onboarding, and the unified multi-chain interface addresses the fragmentation that frustrates even experienced users.

The $72 million in funding and participation from major industry figures demonstrate confidence in Warwick's vision. The transparent handling of the Sonar Sale challenges, where the team adjusted valuation based on market feedback, suggests a pragmatic approach to building.

The concentration of TVL among Patron holders (92%) indicates the platform is still early in its adoption curve. Growing the organic user base beyond initial supporters will be critical for long-term success. The exchange listings on LBank provide accessibility for new users, and the team token unlock scheduled for October 2026 will test market confidence in the project's trajectory.

Whether Infinex can achieve mainstream adoption depends on execution over the coming months. The infrastructure and funding are in place, and the product addresses real problems that have limited DeFi adoption. The project offers a glimpse of what crypto applications could look like when designed for usability without sacrificing self-custody.